test case study 2

Purpose

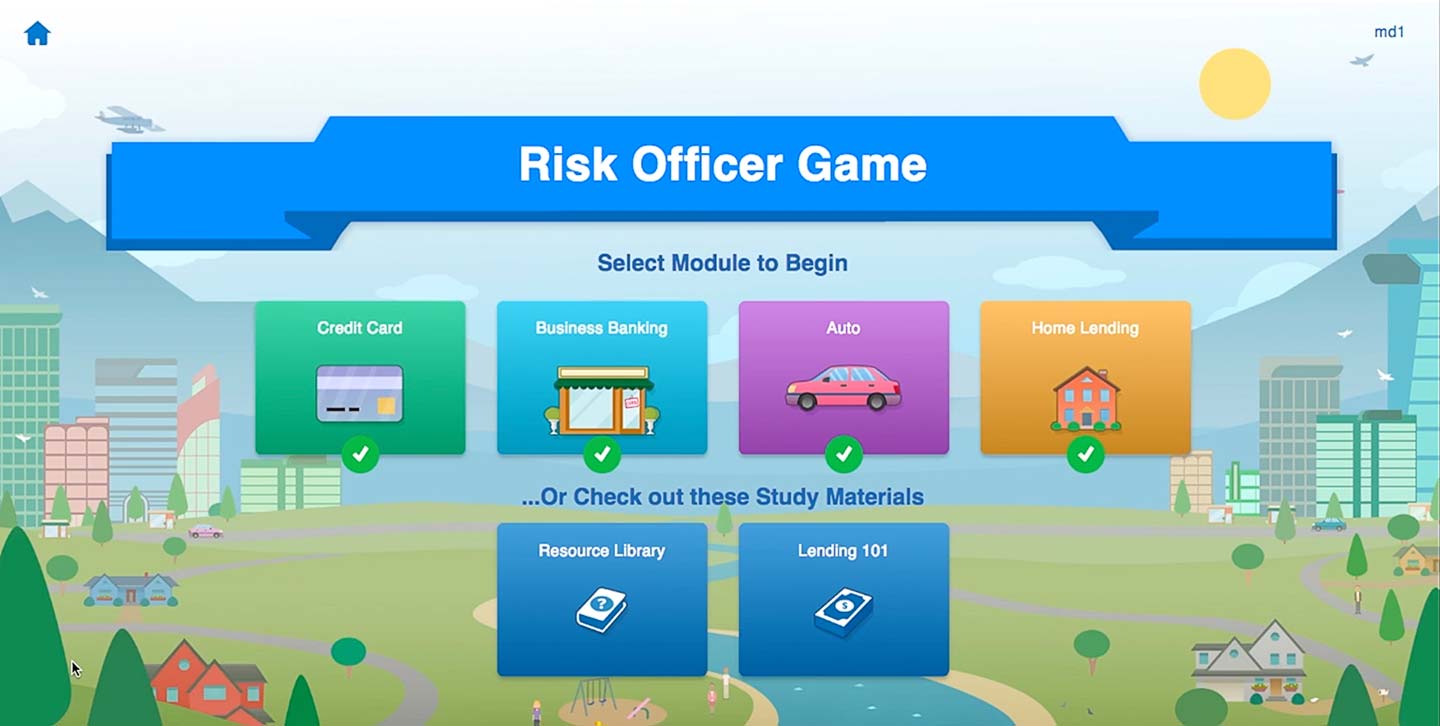

The Risk Officer Game was created to provide corporate employees of one of the largest international banks with the tools they need to teach and assess lending principles while understanding the risks associated with lending money. This game focuses on four major lines of business: credit cards, business banking, auto lending and home lending.

Solution

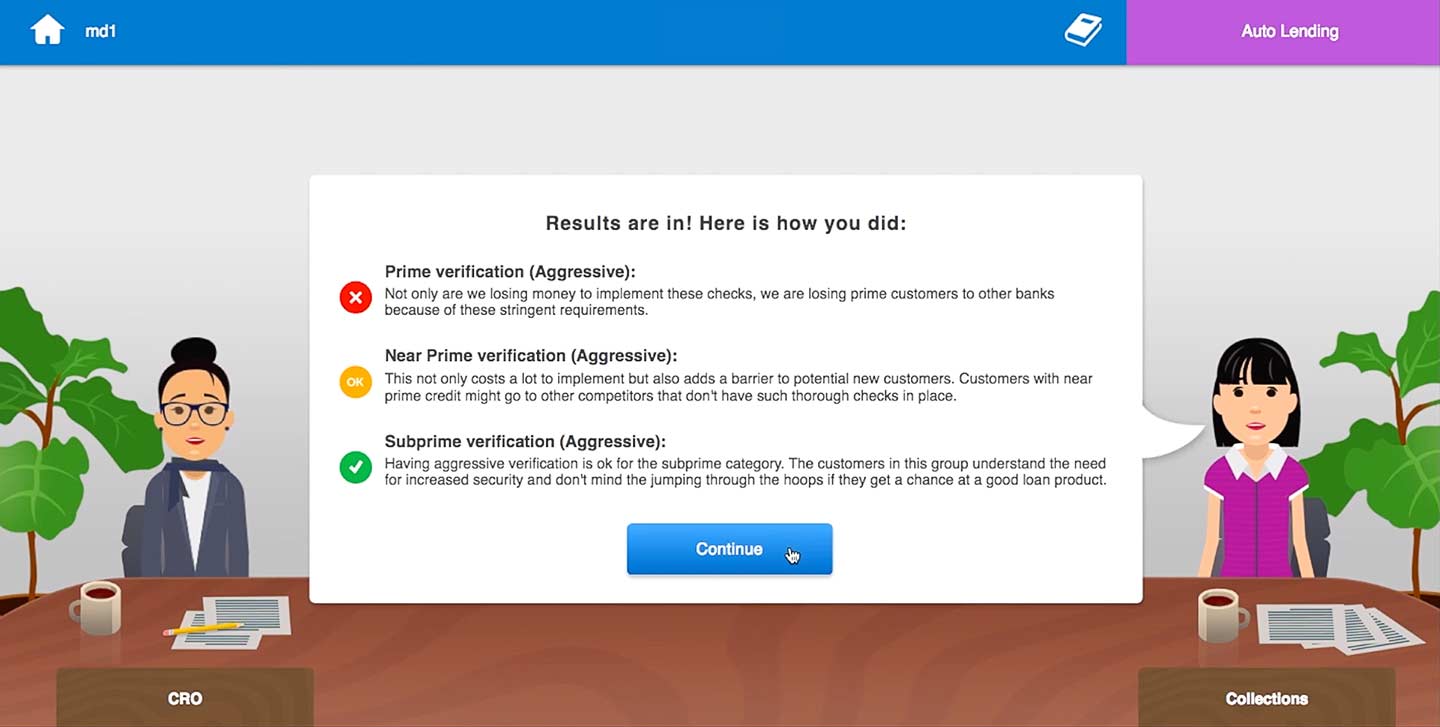

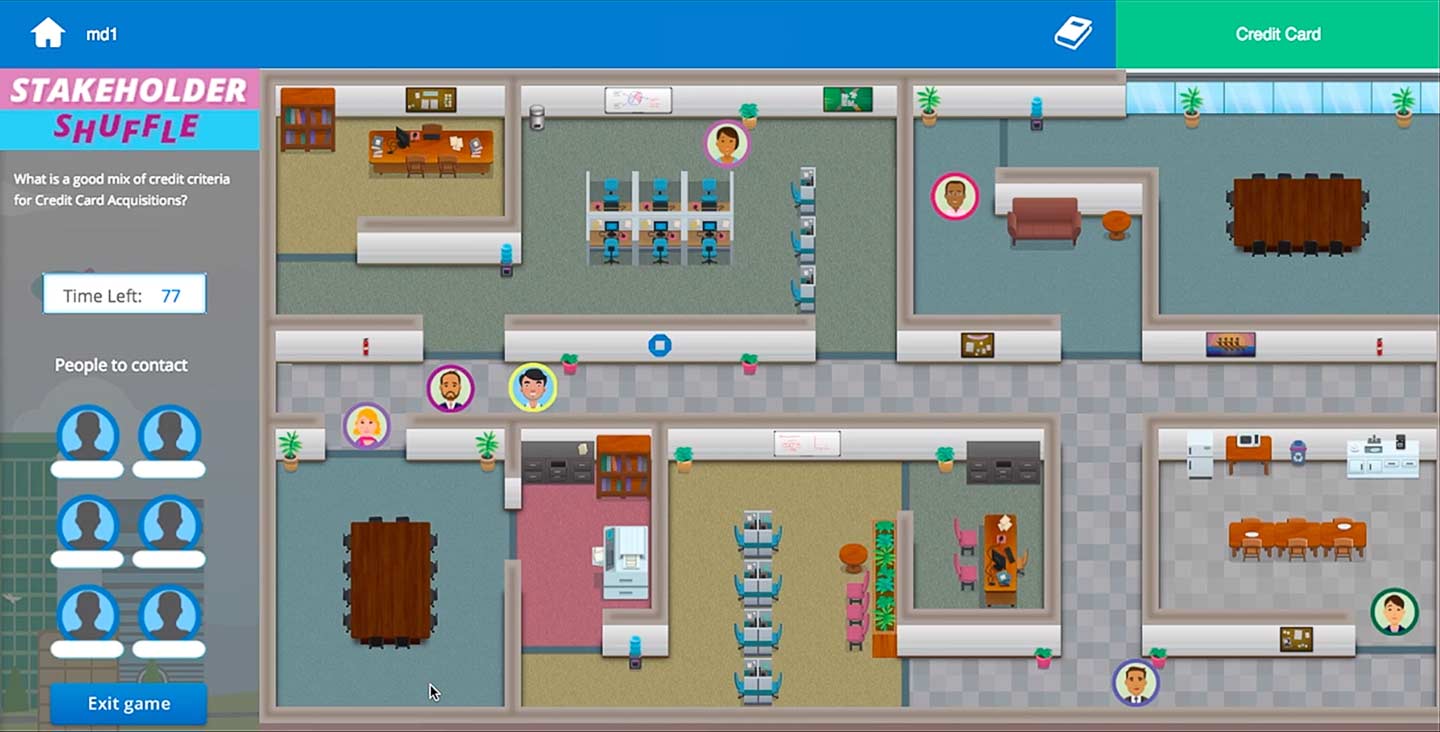

During each lesson, the employees take on different roles provided to them at the beginning of the module. The goal for the learner is to balance out the portfolio through a series of decision based activities in order to reduce the overall risk as measured by the net charge-off rate.

Each module focuses on one line of business and follows a similar flow starting with loan originations and introduction to the portfolio. The learner is exposed to different scenarios involving portfolio management and collections and asked questions regarding the best strategy or course of action to take with the particular scenario. While playing the game, fraud situations will pop-up periodically and the learner has to select action items for each type of fraud detected.

At the end of each section, the user is presented with feedback on their choices through 3 different interactions:

- stakeholder feedback where they get advice from others outside of risk management

- a graph demonstrating how their portfolio is doing thus far and how it has changed based on the decisions they made in the game

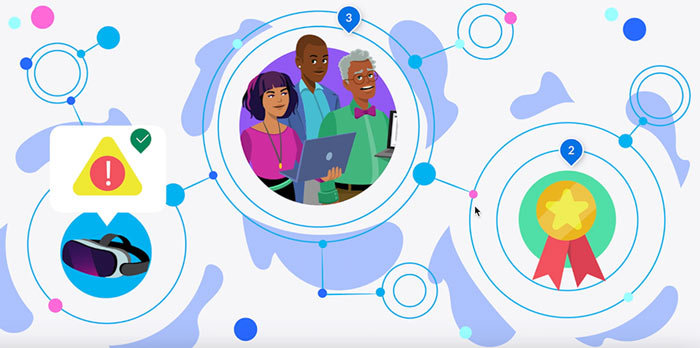

- if achieved: badges (badges are earned when a player not only thinks about credit risk, but other goals inherent in banking such as customer service and profitability)

Added Benefits

This course also includes supplemental resources such as:

- the resource library which the user can access at any point in the game in order to review reference materials and / or glossary terms

- Lending 101 where the player can learn the basics of lending through a series of visual representations and mini activities

This game includes several types of game mechanics including: branching paths, trivia, word scramble, drag and drops, match 3, and an endless jumper.