Financial Literacy for Grades 9-12

Purpose

This course is a digital web-based financial education program that empowers high school students in grades 9-12, to develop healthy financial habits, act as an informed consumer, and know when and where to ask for help when planning for their financial future. The goal of this course is to develop the foundational knowledge of financial principles, practical application of real-world personal finance skills, promote financial problem-solving skills, and empower students to be the arbiters of their own financial futures. The problems this course aims to address are:

- Research has consistently shown that financial literacy among high school students is low.

- The research also shows that the most financially literate people also have advanced problem-solving skills.

- When students enter into the workforce, they’re often thrust into new situations that require a higher level of financial savvy.

- The top financial stressors for 20 to 36 year olds are saving for the future, knowing how to invest money, and sticking to a budget.

Solution

Through a variety of interactive lessons, students learn several ways to acquire income, develop a savings and investing plan, create a budget, track expenses, make informed purchases, monitor and protect their money, and navigate financial institutions and financial products.

The course includes seven modules, each containing 20-25 minutes of lesson content. Learners will get to practice their new skills in realistic scenarios or simulations that resemble current financial products and tools. It will highlight how to analyze data and make decisions based on current information.

Although each module presents a different subject, each follows a similar flow:

- Introduction to the topic

- Pre-assessment questions

- Self-reflection, which allows students to take a quiz to understand how they personally relate to the subject at hand and to assign them a financial profile

- A series of interactive games and decision-based activities that relate to the lesson and allow students to explore, make mistakes, and ultimately lead them down a path of financial well-being.

- At the end of the module, students take a post-assessment and are guided back to the home screen in order to move onto the next lesson. From the homescreen, they can always view their assessment score, re-take their assessment and also replay modules.

Upon completion of the students will gain confidence in:

- Engaging with financial institutions and picking the right products for their life and financial goals.

- Navigating the choices and paperwork presented when starting a new job.

- Setting short-term and long-term financial goals and create a personal budget that tracks spending

- Proactively research purchase decisions and select the best way to pay for those purchases

- Making wise debt management practices and avoid expensive borrowing behaviors

- Developing a plan for financing postsecondary education or training

- Becoming aware of the need for a risk management strategy and how insurance plays a role

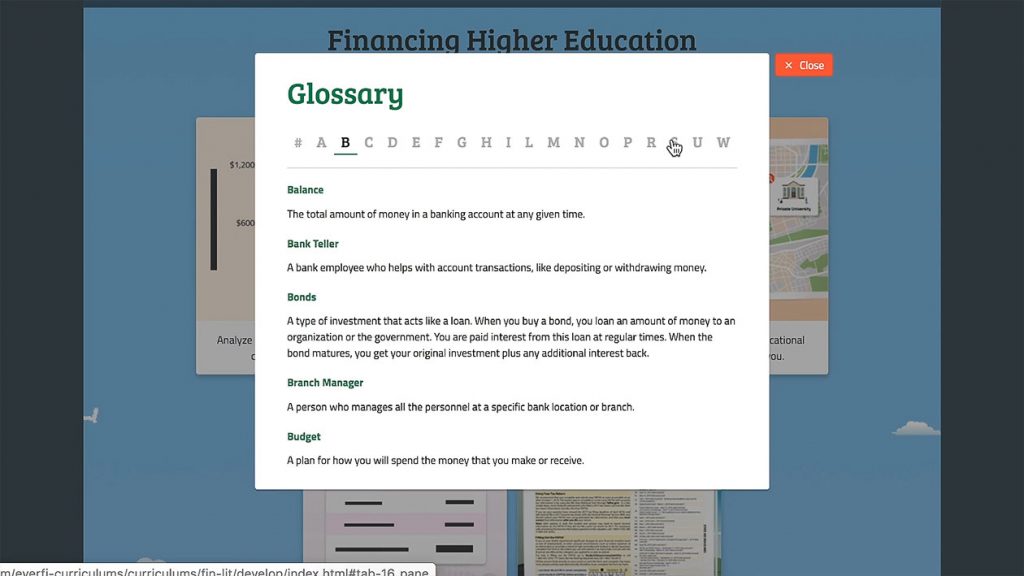

The content of this course aligns with the standards set by Jump$tart National Standards in K-12 Finance Education. This course also includes a glossary that the student can access at any time in order to review terms and vocabulary acquired throughout the modules.

The goal of this course is to develop the foundational knowledge of financial principles, practical application of real-world personal finance skills, promote financial problem-solving skills, and empower students to be the arbiters of their own financial futures.