Financial Literacy App

Purpose

This mobile-first learning application was developed to teach financial literacy to adults of all ages and education levels. This course was designed to be an engaging and informative tool for adults to find the optimal path to financial health.

Solution

This mobile application and digital subscription service has an extensive content library. Banks of any size can “white label” this product, customize it with their branding, and offer it to their customers. It includes marketing materials and executive level data and impact reporting.

This learning solution allows banks:

- To build their financial literacy programs at scale

- Deepen existing customer loyalty programs

- Inform strategy with data insights

The content library covers in detail the following topics:

- Banking Basics

- Retirement Planning

- Building Financial Capability

- Investing in Your Future

- Home Ownership

The library is continuously being expanded and is ADA compliant. Each course is 3-6 minutes long.

The content focuses on 4 key points:

- Understanding the Why: it’s important that the adult learner understands why this information is good to know and how it’s relevant to their daily life. In order to do this, the course focuses on encouraging the learner to think about their own financial goals.

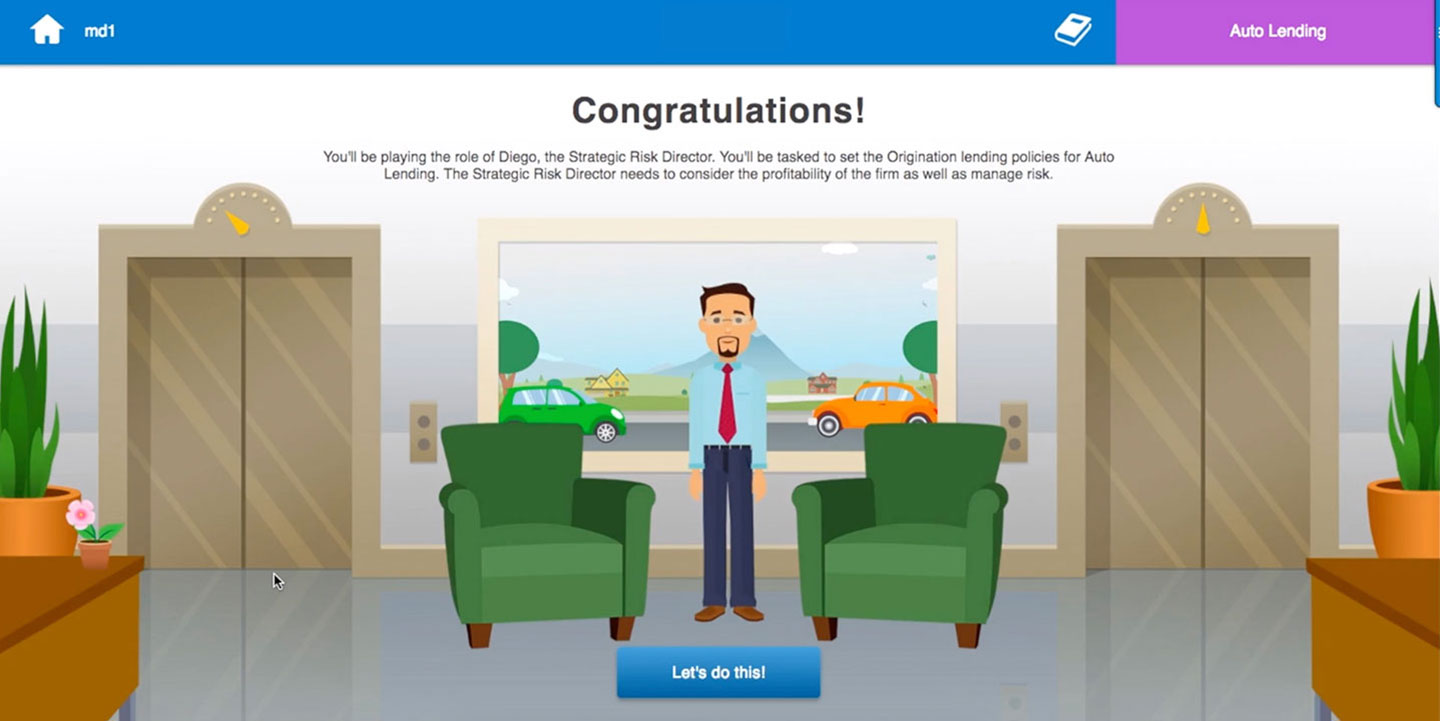

- Application and Practice: active learning increases knowledge retention (even if they make mistakes along the way)

- Problem Solving: adults learn best when they grapple with a problem and work towards a solution

- Just-in-Time: adults learn best when the information is for immediate use

This course is a mobile-first solution. Persona targeting or micro targeting is used in sequences to set groups of learners on content paths that adhere to their individual scenarios via adaptive pathing.

Throughout the course, there are engagement tools such as calculators, scenarios based Q & As, timelines and interactive maps that are intended to encourage or deepen learning comprehension.

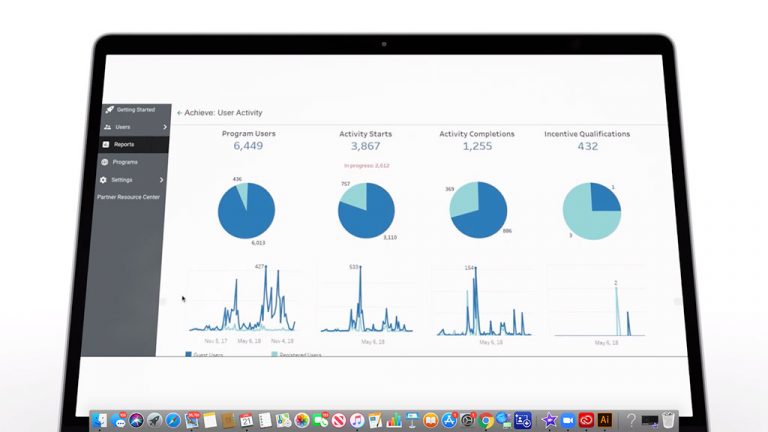

This course also includes a robust data dashboard for a bank to fully understand their audience and where the learning gaps may lie.

900+ financial institutions have used this course and 1.6 million learners are reached each year. Financial institutions with this course have seen an 80% year-over-year increase in website visits.

The special balance between custom course design, artwork and development is what sets this course apart, leading to higher engagement and ultimately increased learner retention.